Dow Jones US Hotel Index:

The weekly chart is showing that this index is

at overhead resistance...

(The hotel stock charts below use a daily format)

Testing overhead resistance while showing

some negative divergence on the oscillator's...

Testing overhead resistance on declining volume...

Will FCH overcome its 50 & 200ma and keep the

uptrend channel intact?

Potential bear flag.

Note the recent distribution days...

Pennant. Watch which way it breaks...

Broke downwards from a raising wedge...

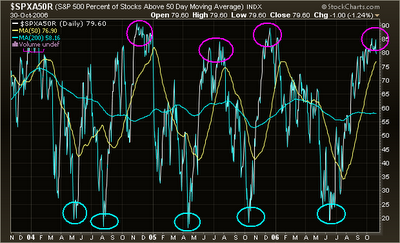

Mean reversion comes to mind...

Charts and comments are NEVER INTENDED AS ADVICE...

Have a great Halloween!

00K

EMAIL- hotspotcharting-ook@yahoo.com